Portfolio Update: April

As of April 30 - Updated Monthly

Important: Before considering any investments, please ensure you understand what to expect.

Activity

Added 89 shares of Alpha Metallurgical Resources (AMR) at $118.42 on April 3. Increase in existing position (see Mohnish Pabrai’s Coal Bet).

Added 495 shares of Warrior Met Coal at €41.80 on April 3. New position (see Mohnish Pabrai’s Coal Bet).

Added 2,992 shares of TUI at €5.74 on April 4. Increase in existing position (see TUI Group: My Largest Investment Yet)

I had planned to sell my FORIS position in April, but their latest annual report made me change my mind.

I provide more details on these moves in the “Notes & Updates” section at the end of this post - including an updated valuation of FORIS.

My Thoughts on the Recent Market Developments

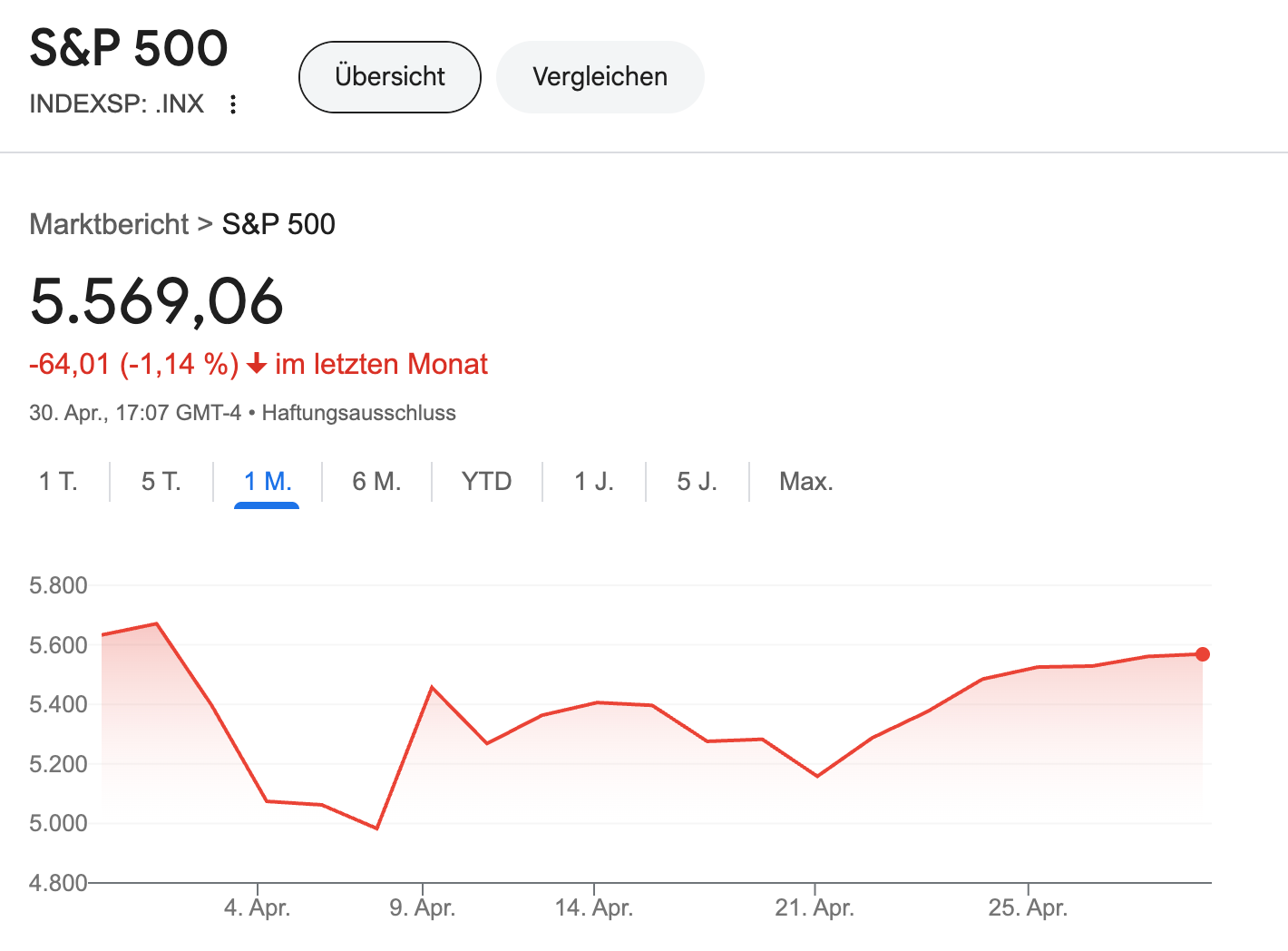

April is over, and prices have ended up right where they started the month. Stocks are now about 5% cheaper than they were at the beginning of the year—but still 10% more expensive than this time last year.

In terms of actual price levels, not much happened.

But if you followed the news, it certainly didn’t feel that way.

I don’t want to add to the noise and I don’t know what prices are going to do. But I think I know what Buffett would have told his partners in the 1960s if they were worried about falling stock prices:

Unless your family owns a bakery, you’ll probably buy more bread than you’ll sell over the next couple of years. So if the price of bread goes down, each euro will buy you more bread—and you will be happy.

You’ll likely be a net buyer of stocks as well. A stock gives you a claim on a company’s earnings—so if prices fall, each euro you invest buys you more earnings. That should make you happy.

Declining stock prices also reduce risk. I bought my first 4,000 TUI shares in November at a price of €7.62 per share. When the price declined to 5.74€ in April, I added another 3,000 shares. Not because my expected gain has increased (which it did), but because I believe at this price the risk of permanently losing capital is very low.

When To Be Greedy

There’s a famous Buffett quote that is often misunderstood: "Be fearful when others are greedy, and greedy when others are fearful."

The problem with this quote is that many people have gone broke by doubling down when the shit hit the fan. Just think of the investors that doubled down on their Enron or Wirecard bet when prices first started to fall. Being “greedy when others were fearful” didn’t work out so well for them.

What Buffett really means is this: he’s only greedy when others are fearful because he’s already done the work. He has thoroughly analyzed the business, valued it conservatively, and built in a margin of safety. He focuses on downside protection first. Only then does it make sense to double down when prices fall. But most investors don’t operate that way. And I think they’re better off being fearful.

So if you aren’t already, now might be the right time to become a value investor.

You will be looking at company fundamentals instead of stock prices. You will read books and annual reports instead of news headlines. And you won’t feel the urge to constantly check your trading app. You will also become very rich (and stay rich), although that will take some time.

It’s a rewarding process, and it lets you sleep well at night.

To learn more about value investing, check out my latest tutorial:

My Current Portfolio

This is my current portfolio - and your starting point, if you want to mirror my performance going forward. For details, see “How To Use”.

My current portfolio and detailed updates are exclusively available to paid subscribers (find out more). The latest free update is my 2024 performance review.

Keep reading with a 7-day free trial

Subscribe to Till's Value Portfolio to keep reading this post and get 7 days of free access to the full post archives.