Portfolio 2024

My Portfolio and Performance Throughout 2024

Important: Before considering any investments, please ensure you understand what to expect.

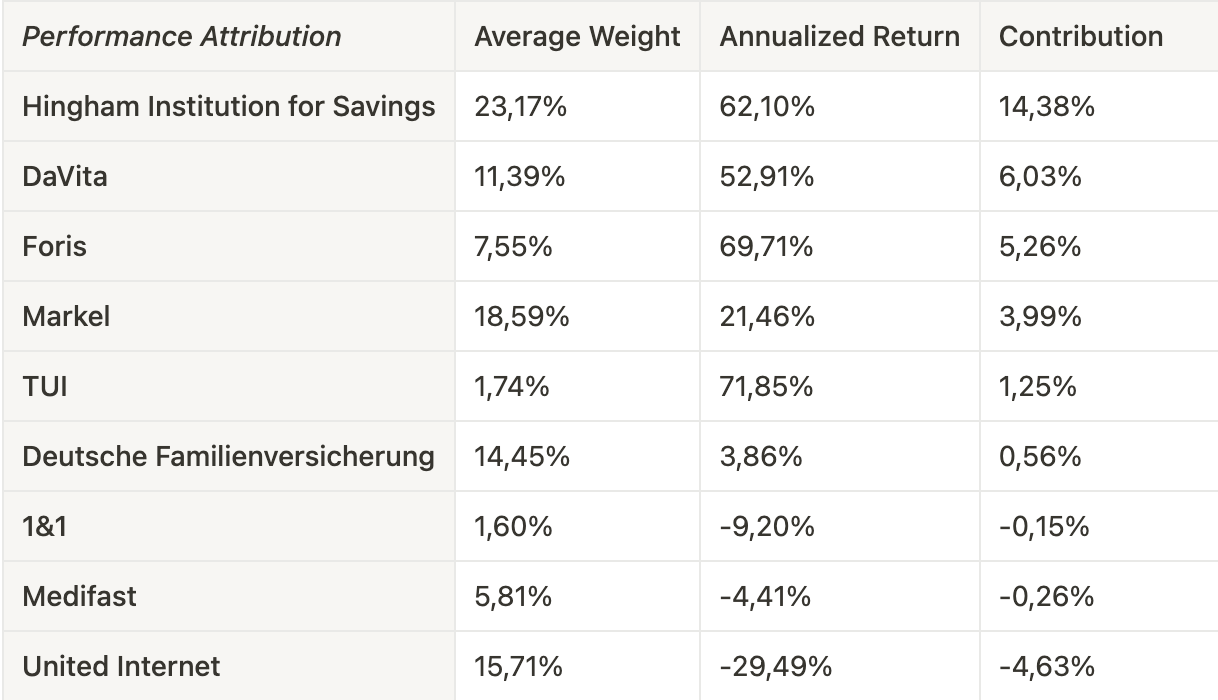

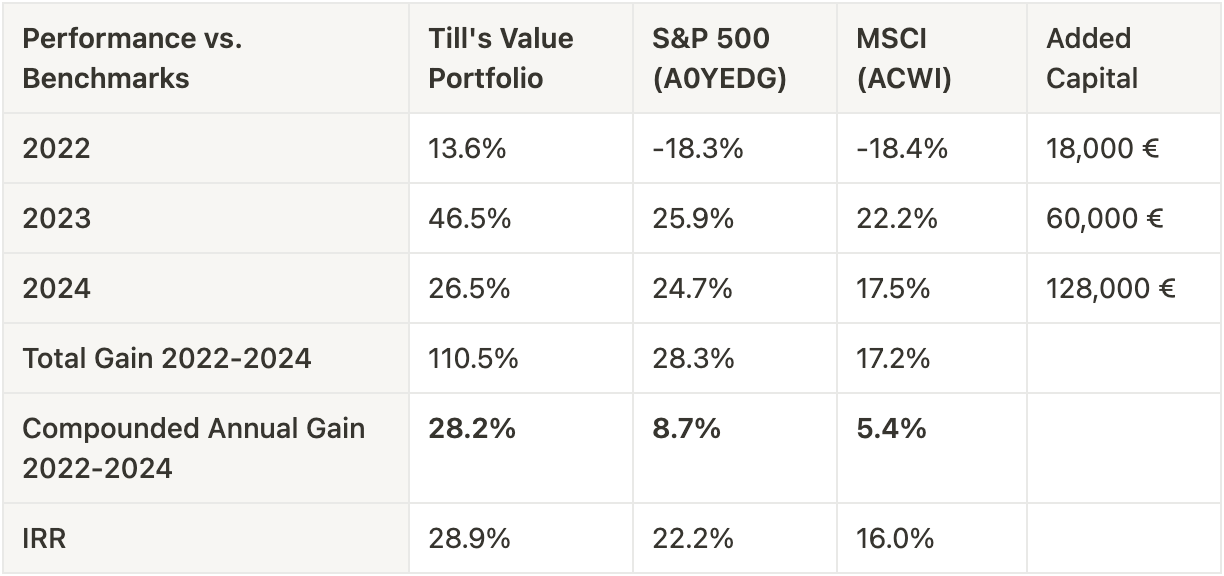

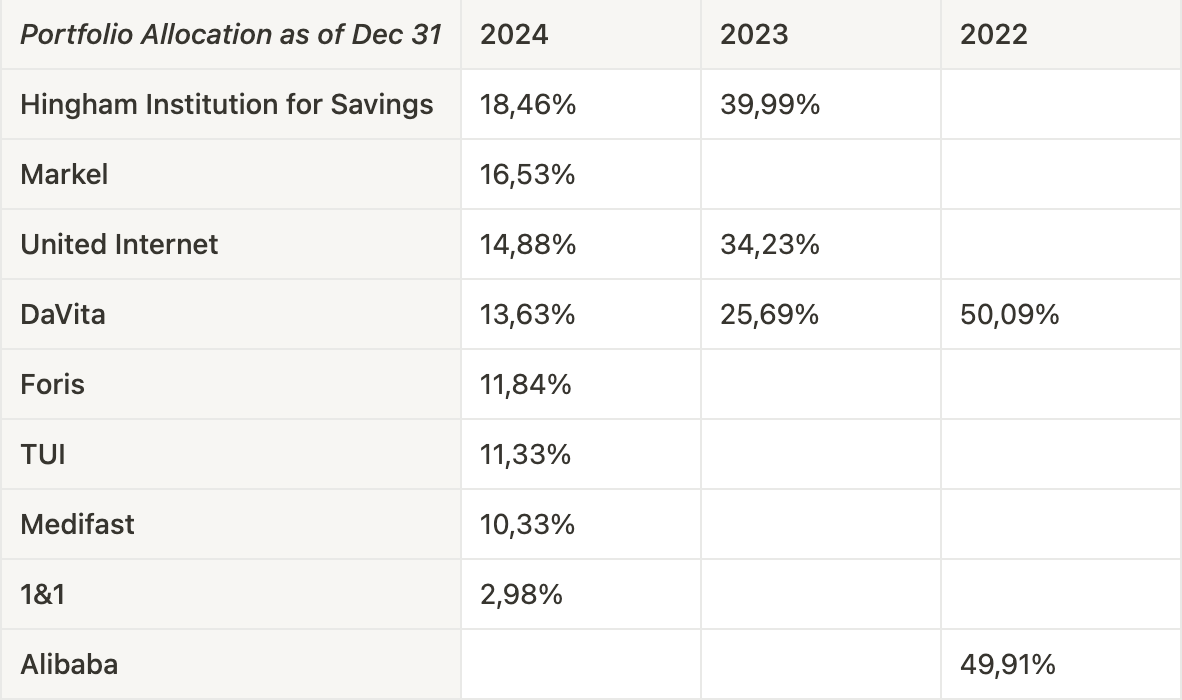

In 2024, I beat the market by a small margin. I consider this a very good result, because I achieved it while only investing in undervalued companies. Here’s how my portfolio looked at the end of the year:

I’ll be sharing detailed analyses of all my investments over the next few months, but here’s a quick overview of the new additions to my portfolio in 2024:

Markel: I’ve spent a lot of time studying Berkshire Hathaway and its valuation approach. When I applied the same methodology to Markel, I found that their shares were significantly undervalued.

Foris: I looked at every public German company with a market cap of less than €100 million and found a true “net-net” situation in Foris. When I bought in, the company’s market cap was actually lower than the value of the office building it owned.

TUI: I came across a TUI analysis on valueinvestorsclub.com. It took me a lot of time to fully understand the company, and while my own valuation came in lower than the one in the analysis, it was still well above the market cap.

Medifast: I read about it in Adam Mead’s newsletter and followed his reasoning. This is a riskier bet, but I see the potential for asymmetry—either I win big, or I don’t lose much. I’m comfortable with that kind of risk.

Deutsche Familienversicherung (see next table): I believed the stock was undervalued, and I intended to hold it for the long term (one year being my minimum holding period). However, the company was delisted at the end of the year at roughly the same price I initially paid.

Before you expect too much from the detailed analyses, it’s important to note that the total return I saw in 2024 was largely driven by just two ideas. These were positions I’ve held since 2023, and interestingly enough, neither of them were originally my own ideas.

Let me know if you have any questions on my performance in 2024.