Important: Before considering any investments, please ensure you understand what to expect.

Reporting Update

This will be my last monthly update. Going forward, I’ll switch to quarterly updates for everyone, and same-day live updates of all my activity exclusively for paid subscribers. That way, it’ll be easier to follow my moves and get in at the same prices I’m paying.

June Activity

Added $77,000 of WW International (WeightWatchers) bonds at 29 cents on the dollar between June 10 and June 12, during the WW bankruptcy (see my analysis, part 1 and part 2).

After the bankruptcy was completed, the bonds were cancelled and I received $21,000 in new notes paying roughly 11% interest, plus 433 shares of the new equity.

On July 1, I sold the shares at $30.75.

On June 18, I shorted 20 put option contracts on TUI (each contract = 100 shares) at €0.96 per share.

I provide more details on these moves in the “Notes & Updates” section at the end of this post—including the final outcome of my WeightWatchers bet.

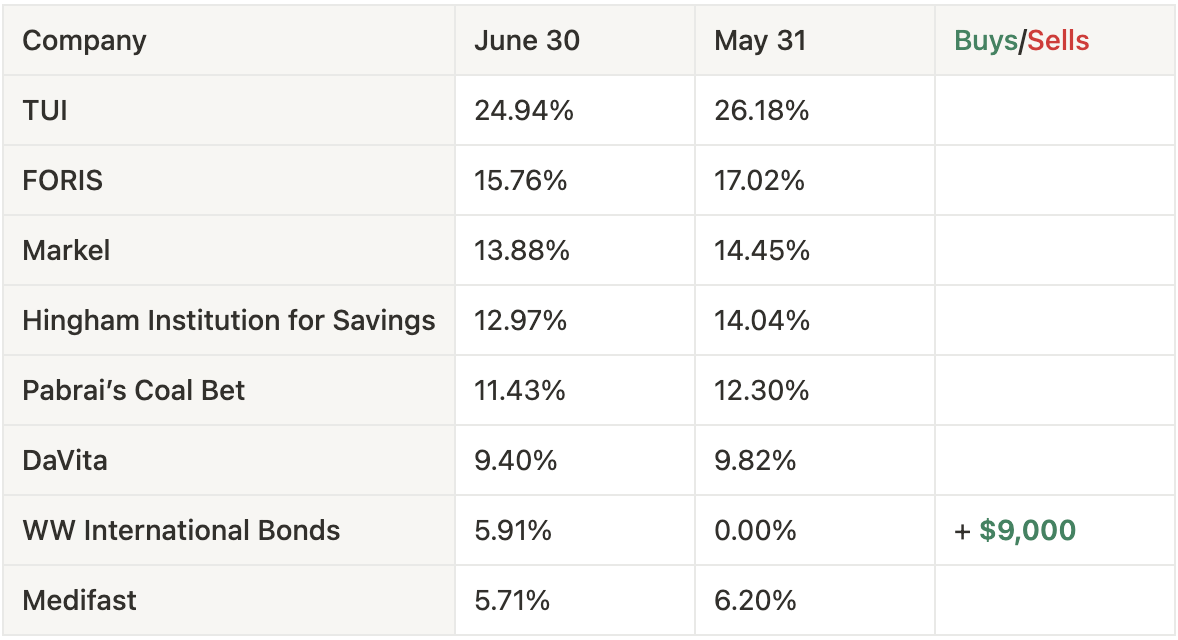

My Current Portfolio

This is my current portfolio - and your starting point, if you want to mirror my performance going forward. For details, see “How To Use”.

Comment: Why Your ETF is Down for the Year

Quick math puzzle: The MSCI All World (ACWI) index is up almost 11% for the year. If you had invested €100 on January 1, 2025—how much would you have today?

The answer: about €97. That’s a performance of -3%.

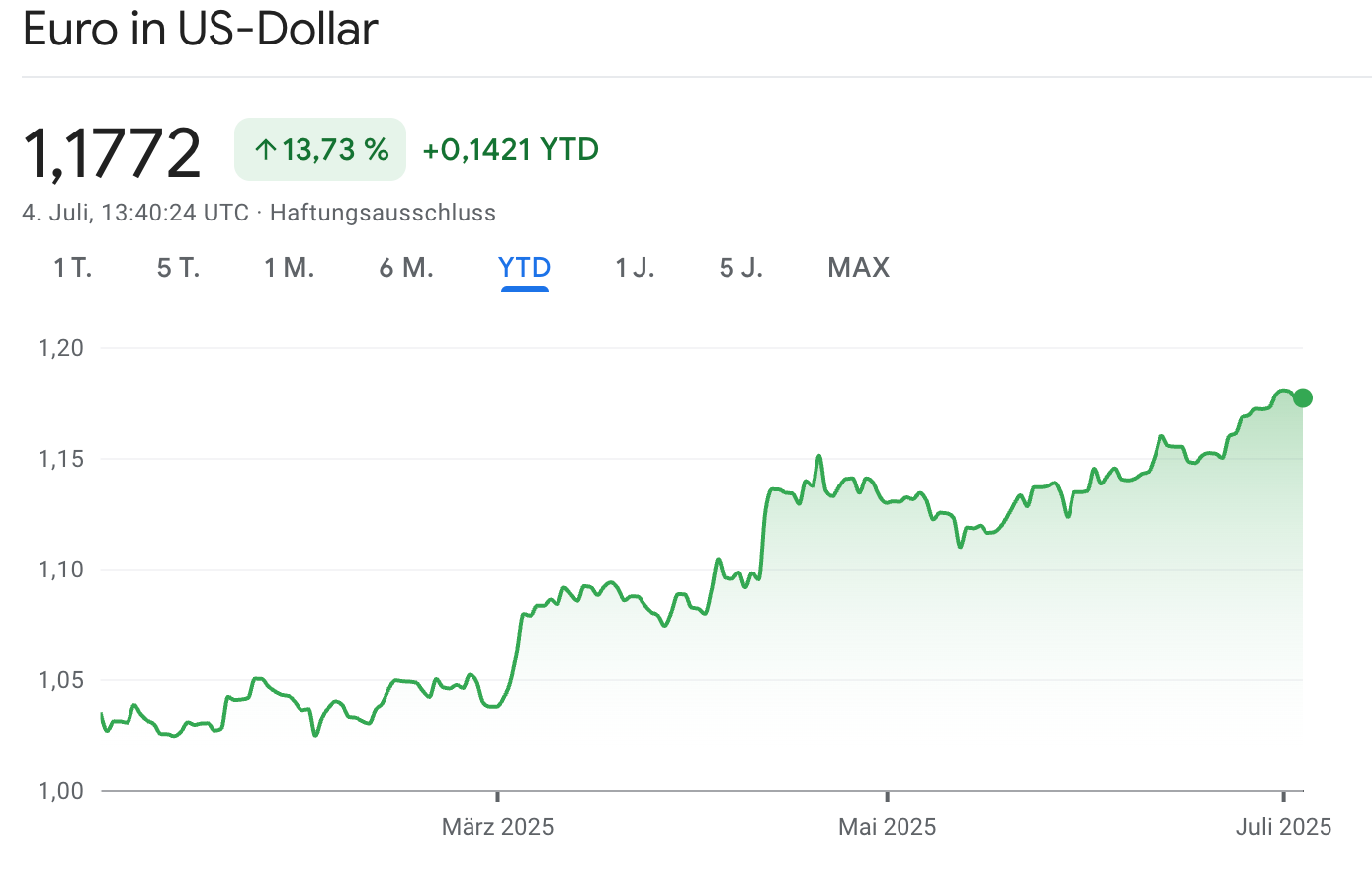

Why? Because of the weak dollar. You can’t buy “the index”—you can only buy it through an index fund. That fund is usually denominated in dollars (or at least invests heavily in dollar assets). So when the dollar loses value against the euro, it eats into your returns—even if global stock prices are rising.

So to see your true performance, you have to factor in the currency impact like this:

On January 1, you exchange €100 for $104 (EUR/USD at 1.04).

You invest the $104 in an ETF tracking the MSCI All World.

That investment grows to $115 ($104 × 1.11) by today, up 11%.

But when you convert it back at today’s exchange rate of 1.18, you only get €97.

So your total return is -3%, despite the index being up 11% in dollars.

Of course, you don’t actually have to exchange money yourself—most ETFs and even many large individual stocks can be bought directly in euro. But that doesn’t shield you from currency effects. The performance still reflects what happens in dollars, just translated into euro.

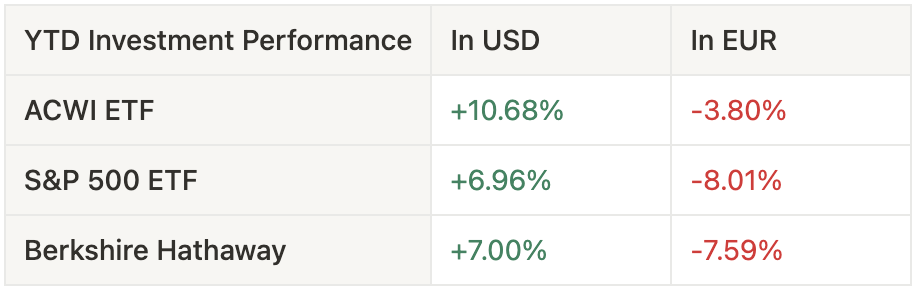

Here’s a quick overview of how currency moves have impacted popular investments this year:

What does this mean for you?

If you’re a passive investor, honestly—nothing changes. Just keep doing what you’re doing. Over the long run, currency effects tend to balance out, and sticking with your plan will still serve you best.

If you are an active investor, please don’t start fooling yourself by stating returns in constant currency. It doesn’t help to say you’d have stellar performance without the currency effect, because you didn’t hedge and so you don’t have a great performance.

The only sensible way to look at it—and the approach I’ll take in my own annual review—is to compare your returns to the index in the currency you invest in. For me, that means stating my performance in euros and comparing it to the euro-based performance of the indices and Berkshire, because that’s where I’d put my money if I didn’t pick individual investments.

Notes & Updates

I broke my Investing Principle #6 by opening a new position with less than 10% of my portfolio value—and I regret it. The WW International bonds were only about 6%. At the time, I told myself this principle didn’t need to apply to special situations like bankruptcies. In hindsight, I’m not sure how that makes any sense—the whole point of the principle is to stop me from investing too little in each position, regardless of the situation. There shouldn’t be exceptions.

As for the other positions now below 10%, that’s either because they declined in value or were diluted when I added more capital to other holdings.My WW International (WeightWatchers) bet worked out perfectly. The only thing I regret is not buying more. I invested $22,000 in defaulted WW bonds during the bankruptcy. After the restructuring, I received $21,000 worth of new five-year bonds paying around 10% annual interest, plus 433 shares of the new equity.

I then sold the shares shortly after they started trading for roughly $13,000. That means my net investment in the bonds is now just $9,000 ($22,000 minus the $13,000 recovered from the stock sale).

If the company makes all its debt payments, I’ll receive around $32,000 over the next five years. Based on my $9,000 investment, that’s a 260% total return—or nearly 30% annualized.

I learned a lot from this investment, but it also made me question my ability to go big when I come across a truly unique opportunity. The economics of the bet were clearly laid out in the bankruptcy filings—there was no solid reason to hold back. But I still did, and left a lot of money on the table. All good, though, as long as I learn from my mistakes (and even better when my mistakes still end up making money).

Every time TUI “crashes” for a couple of weeks over something silly—like the fear of rising oil prices—I feel compelled to act. I don’t really want to keep adding more capital to my TUI bet, since I could still be wrong. But just watching the price drop without benefiting doesn’t sit right with me.

So in May, I bought call options that give me the right to buy more TUI shares at a very low price of €6.50 until the end of next year.

Then in June, I shorted put options. That means I sold puts on TUI without owning them, collected €1,920 upfront, and am now obliged to buy 2,000 TUI shares at €6.40 until June 19 next year—if the price falls below that level. Factoring in the premium I received, my effective purchase price would be just €5.44. If the price stays above €6.40, I simply keep the fee and won’t have to buy anything.

Big thanks to my friend Henrik for pointing out this approach—and the fact that Buffett used the same method to lower his purchase price on Coca-Cola!

If you’re a free subscriber, you’ll get my next full portfolio update in early October. Paid subscribers receive real-time updates—so you’ll see every move I make on the same day.