Disclaimer: Make sure you fully understand the situation before you consider investing. In Part One, I outlined the background—please read that article first if you haven’t already.

Summary

After studying this situation in more detail, here are the key adjustments to my initial thesis:

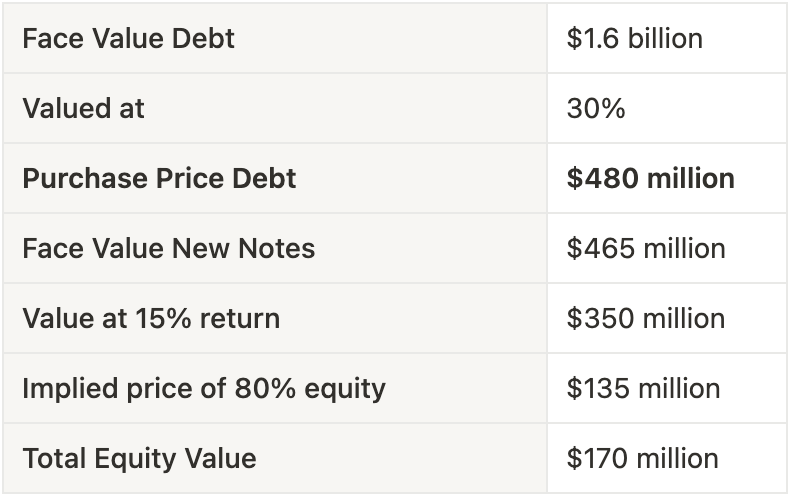

I was correct in noting that we can currently buy the $1.6 billion in outstanding debt for 30 cents on the dollar—that is, for $480 million. However, I was slightly off in my understanding of what we’ll receive in return after the bankruptcy process concludes.

I had initially assumed that once the bankruptcy is completed, we would receive:

$465 million in new notes (due in five years), paying 7.50% annual interest, and

91% of the new equity.

However, I’ve since learned that the new debt will actually pay SOFR + 680 basis points, which comes out to roughly 11% interest at today’s rates—not 7.5%. That significantly improves the expected cash flows from the debt.

As for the equity, the 91% stake is subject to dilution from a new equity incentive plan. The exact terms haven’t been disclosed yet, but I think a 10% pool is a reasonable assumption. In fact, I prefer it that way—I want management to own 10% of the equity so they’ll make sure it’s actually worth something.

Assuming the company does not default on the new debt and the average interest rate over the next five years is 10%, we’d receive about $700 million from the new notes:

$465 million principal

$46.5 million in annual interest × 5 years = $232.5 million

My hurdle rate is a 15% annual return, so I’d be willing to pay $350 million for that stream of payments. That leaves $135 million of value to be attributed to the equity.

Since we’re getting roughly 80% of the equity (after assuming 10% dilution from management incentives), that implies a price of the total equity of about $170 million. To summarize:

So the key questions are:

Keep reading with a 7-day free trial

Subscribe to Till's Value Portfolio to keep reading this post and get 7 days of free access to the full post archives.