Important: Before considering any investments, please ensure you understand what to expect.

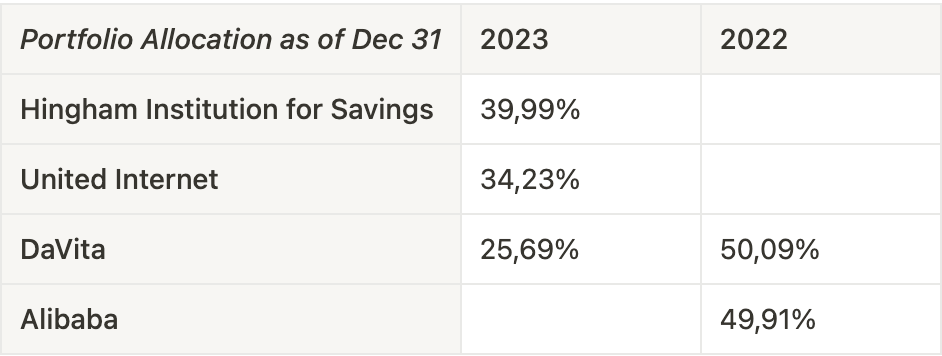

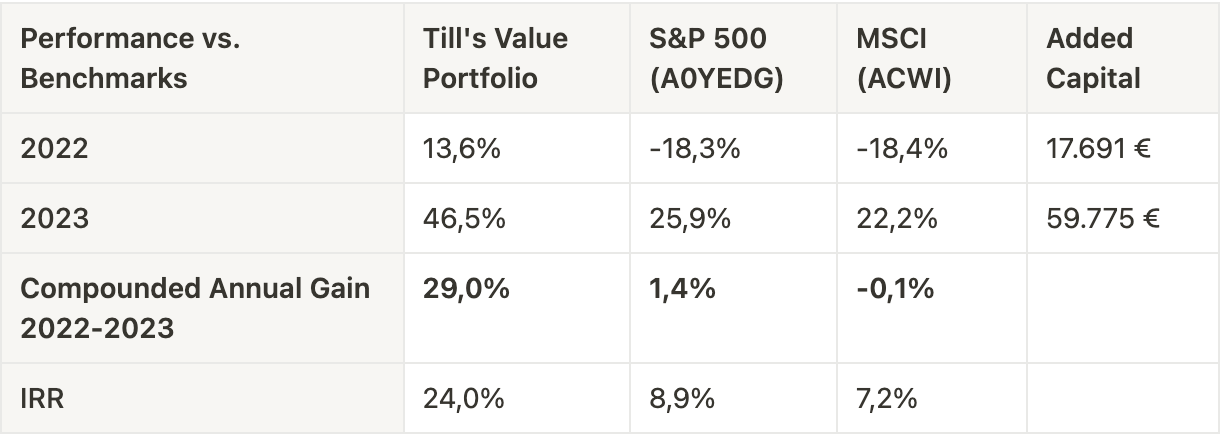

2023 was my first full year as a value investor, and it couldn’t have gone better. While I’m still pleased with the decisions I made back then (writing this in 2025), I view the outcome as pure luck. I held five investments throughout the year, though two were relatively insignificant. With only three meaningful positions, a 46% gain seemed just as likely as a 46% loss. Here’s how my portfolio was allocated at year-end:

I’ll be sharing detailed analyses of all my investments over the next few months, but here’s a quick overview of the new additions to my portfolio in 2023:

Hingham Institution for Savings: This was an idea from Adam Mead, a banking expert who allocated 30% of his clients' capital to the company. I trust his judgment at least as much as my own (see investment principle number 4), and the stock was available at an even lower price than what he paid.

United Internet: A highly profitable company led by its founder, who owns 50% and whom I consider Germany’s best entrepreneur. I was able to buy in at a price well below book value with a 4% dividend yield. The low valuation was due to an ambitious and risky project the company launched in 2019, which will absorb all its cash flows for years—at least until 2030. Most investors shy away from such long time horizons. I don’t mind the wait.

Activision: A merger arbitrage play that both Berkshire and Adam Mead were involved in. Microsoft had announced plans to acquire Activision, but uncertainty around regulatory approval kept the stock price below the offer price. I invested €10,000, and when the deal was finalized shortly after, I made a €1,000 profit. It didn’t move the needle.

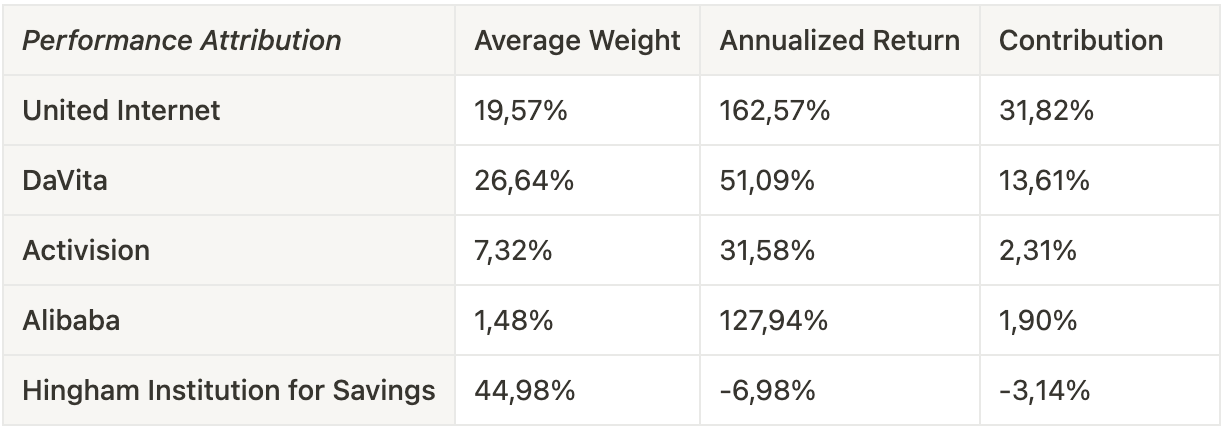

As the table below shows, nearly 70% of my 2023 performance came from United Internet—a bet with a time horizon extending at least until 2030. That makes the short-term gain in 2023 largely irrelevant to me. However, without it, my first full year as a value investor would have looked quite different.